onflashigri.online

News

Forms Of Id To Cash A Check

• Employer ID w/photo. • Employer Pay Stub / Pay Check / Letter with name & address. • Other U.S. Federal/State issued ID with or w/o photo. • Social Security. Ask what you need to have them write on the back of the check, and be sure to ask if you both need to be present to deposit it. Some banks require a form of ID. What are accepted forms of ID to cash a check? · Driver's license · Passport · State-issued ID card · Birth certificate (if a minor) · Social Security card (if a. A government issued ID. This form of identification verifies who you say you are by allowing the bank to match up your face to your name. · Social Security Card. Along with your check, bring your Social Security or Taxpayer Identification Number and one of these forms of ID: US-issued Passport; State-issued ID; Driver's. Get cash in a flash. Bring your check & valid ID to a Walmart store. Debit with rewards. Get three percent cash back at Walmart. Terms apply. Debit with. Driver's license; Photo ID; Passport; Visa; Military ID; Tribal ID. Examples of Secondary ID: Alien registration photo card; College photo. Along with your check, bring your Social Security or Taxpayer Identification Number and one of these forms of ID: US-issued Passport; State-issued ID; Driver's. U.S. Supermarket Check Cashing Card (must have signature and pre-printed name) Complete Application for Permit, Driver License or Non-Driver ID Card (form MV-. • Employer ID w/photo. • Employer Pay Stub / Pay Check / Letter with name & address. • Other U.S. Federal/State issued ID with or w/o photo. • Social Security. Ask what you need to have them write on the back of the check, and be sure to ask if you both need to be present to deposit it. Some banks require a form of ID. What are accepted forms of ID to cash a check? · Driver's license · Passport · State-issued ID card · Birth certificate (if a minor) · Social Security card (if a. A government issued ID. This form of identification verifies who you say you are by allowing the bank to match up your face to your name. · Social Security Card. Along with your check, bring your Social Security or Taxpayer Identification Number and one of these forms of ID: US-issued Passport; State-issued ID; Driver's. Get cash in a flash. Bring your check & valid ID to a Walmart store. Debit with rewards. Get three percent cash back at Walmart. Terms apply. Debit with. Driver's license; Photo ID; Passport; Visa; Military ID; Tribal ID. Examples of Secondary ID: Alien registration photo card; College photo. Along with your check, bring your Social Security or Taxpayer Identification Number and one of these forms of ID: US-issued Passport; State-issued ID; Driver's. U.S. Supermarket Check Cashing Card (must have signature and pre-printed name) Complete Application for Permit, Driver License or Non-Driver ID Card (form MV-.

Cash may also include cashier's checks, bank drafts, traveler's checks, and money orders with a face value of $10, or less, if the business receives the. This verifies that you are who you say you are and allows the bank to match your name and face. The most common forms of government-issued photo ID are a. ▫ has another form of ID, check the document lists in Step 5, confirm it's acceptable, and then continue. ▫ Doesn't have acceptable ID,. Don't cash the bond. Forms · Records · Offices · Most Popular. Search Both types of cards allow you to legally drive and prove identity and age for things such as cashing a check. Examples of Primary ID: Driver's license; Photo ID; Passport; Visa; Military ID; Tribal ID. Examples of Secondary ID: Alien registration. To show that the check rightfully belongs to you, you'll need to show at least one form of government-issued identification, such as a license or passport. With. Government-issued photo identification. Contact us. • Employer ID w/photo. • Employer Pay Stub / Pay Check / Letter with name & address. • Other U.S. Federal/State issued ID with or w/o photo. • Social Security. U.S. Supermarket Check Cashing Card (must have signature and pre-printed name) Complete Application for Permit, Driver License or Non-Driver ID Card (form MV-. The check you want to cash; Government ID; Payment for fees. What forms of ID are accepted? In general, any government-issued form of identification is. How To Cash A Check Without ID · Deposit through your bank's mobile app: If you have a bank account, check if your bank offers a mobile app with. A non-established client must present a form of identification that can be successfully verified using our verification tools in order to be able to cash an on-. Driver's license from a U.S. state; Federal or state ID card; Military ID card; U.S. passport. Other Acceptable Group A IDs: License to Carry a Handgun. All you need is the check itself and some form of identification. Unlike our competitors, Speedy Cash can cash any type of check, including government checks. When cashing a check, having the right identification is crucial. Most banks require at least one form of government-issued photo ID, such as a driver's license. A non-established client must present a form of identification that can be successfully verified using our verification tools in order to be able to cash an on-. Any place that requires an ID to deposit a check will very likely not accept an expired ID. Do they have any other form of identification? In order to cash a check at Amscot, you need a valid government issued photo ID (i.e. driver's license, military ID, passport). By submitting this form. Be sure to have a valid form of ID with you when you go to your bank to deposit a check. Valid forms of identification include driver's licenses and passports. U.S. Government ID: U.S. government-issued U.S. Access card, including a USAccess card or Personal Identity Verification (PIV) card; Tribal identification card.

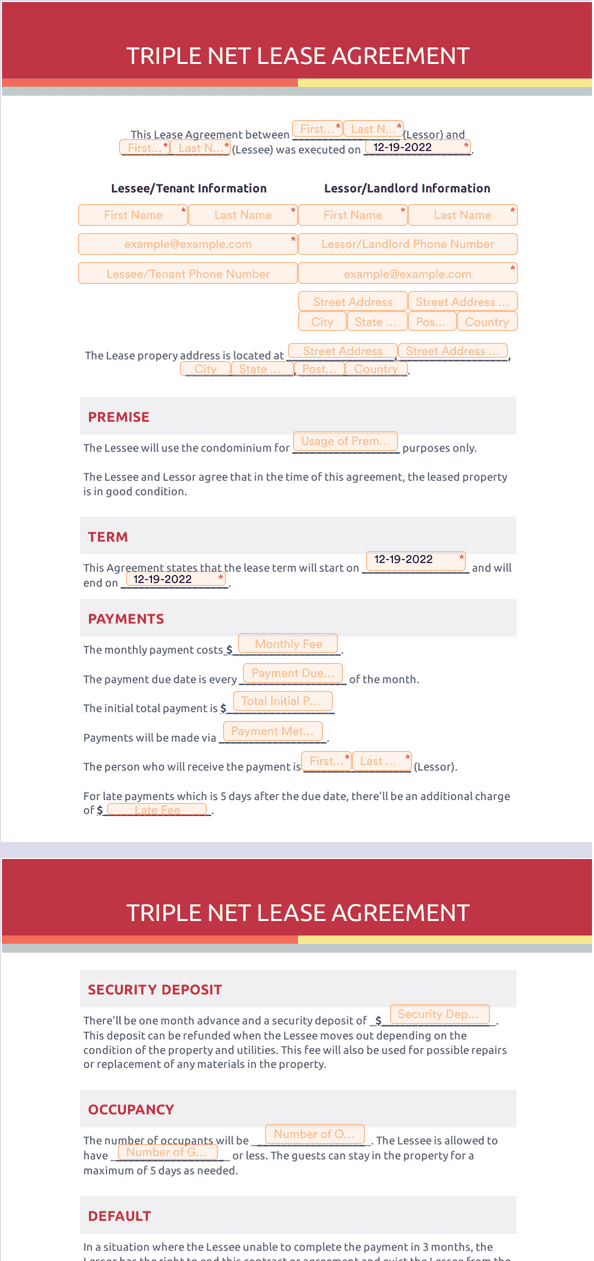

Triple Lease

A Triple Net Lease states the tenant is responsible for certain costs - Property Taxes, Insurance, Operating Expenses + the base rent. What is a Triple Net, or NNN, Lease? A Triple Net, or NNN, lease is a contract in which the tenant is responsible for everything including; taxes, insurance. Triple net refers to leases where a tenant rents an entire freestanding commercial building and pays for all property expenses. A triple net lease is commonly known as an NNN lease, it is the opposite of a gross lease and it places responsibility on the tenant to make three payments in. This complete guide will cover how a triple net lease works, what is included in a triple net lease, and the advantages of this type of lease. At a high-level, a net lease assumes that the tenant will pay a lower base rent than they might pay for a gross lease, but in turn, the tenant is responsible. Triple net rent model: The tenants pay all operating expenses, including property taxes, insurance and repairs and maintenance, either directly or by pass-. A lease that requires only that basic rent be paid, usually on a monthly basis, is known as a “gross lease”. Generally, a lease that requires that a Tenant pay. Triple net lease (NNN). A type of commercial real estate lease under which you typically pay the base rent, plus property taxes, building insurance and. A Triple Net Lease states the tenant is responsible for certain costs - Property Taxes, Insurance, Operating Expenses + the base rent. What is a Triple Net, or NNN, Lease? A Triple Net, or NNN, lease is a contract in which the tenant is responsible for everything including; taxes, insurance. Triple net refers to leases where a tenant rents an entire freestanding commercial building and pays for all property expenses. A triple net lease is commonly known as an NNN lease, it is the opposite of a gross lease and it places responsibility on the tenant to make three payments in. This complete guide will cover how a triple net lease works, what is included in a triple net lease, and the advantages of this type of lease. At a high-level, a net lease assumes that the tenant will pay a lower base rent than they might pay for a gross lease, but in turn, the tenant is responsible. Triple net rent model: The tenants pay all operating expenses, including property taxes, insurance and repairs and maintenance, either directly or by pass-. A lease that requires only that basic rent be paid, usually on a monthly basis, is known as a “gross lease”. Generally, a lease that requires that a Tenant pay. Triple net lease (NNN). A type of commercial real estate lease under which you typically pay the base rent, plus property taxes, building insurance and.

In a Triple Net lease, the Lessee pays a fixed Base Rent plus a proportionate share of the property's operating expenses, insurance premiums, and real estate. With this lease type, the landlord takes on more obligations than the tenant. They are responsible for insurance and property expenses, while the tenant handles. A triple net lease (also known as NNN) is a lease agreement on a commercial real estate property where the tenant agrees contractually to pay the lease as well. Net-net-net or "triple net" leases. Triple net leases pass on all of the costs of operating the building, including repairs and maintenance to the renter. Triple net lease (NNN) is normally a commercial lease where the lessee pays rent and utilities as well as three other types of property expenses: insurance. A Triple Net Lease states the tenant is responsible for certain costs - Property Taxes, Insurance, Operating Expenses + the base rent. Answer: NNN is a lease where the tenant pays all real estate taxes, building insurance, and maintenance, in addition to rent and utilities. What is NNN: Triple-. Absolute Triple Net Lease. Related Content. Also known as a bondable lease. An extreme variation of a net lease, where the tenant is typically. A NNN lease or triple net lease has a provision for the tenant to pay, in addition to the tenant's base rent, costs associated with operations. A triple net lease, or NNN lease, is structured so the tenant is responsible for paying the base rent, property taxes, insurance and all maintenance associated. Triple net leases are contractual lease agreements where a tenant is obligated to pay expenses associated with the property. A Triple Net Lease (NNN) is a lease agreement where, apart from paying the rent, the tenant also pays for all operating expenses. Triple net is common. Read the contract offered and negotiate. It should spell out what you are liable for versus the landlord in great detail. Triple Net Lease – this type of lease absolves the landlord of the most risks as compared to any net lease. With this type of lease, all operating costs. Hidden Costs and Financial Burden One of the most significant dangers of a triple net lease is the potential for unpredictable maintenance costs. In a. Triple Net Lease. The Rent shall be absolutely net to Lessor so that this Lease shall yield to Lessor the full amount of the installments or amounts of the Rent. What is a Triple Net Lease (NNN)?. A triple net lease in Australian commercial real estate obligates tenants to share property expenses (building insurance. A triple-net lease, also known as a “NNN lease,” is a commercial real estate lease type in which the tenant pays their pro-rata share of operating expenses. Triple net (or NNN) leases are leases which require the tenant (lessee) to pay for net real estate taxes, net building insurance and net maintenance costs, in. A triple net lease (also known as NNN) is a lease agreement on a commercial real estate property where the tenant agrees contractually to pay the lease as well.

How To Buy A House That Was Foreclosed

Foreclosed properties have some common problems. In addition, there are some standard difficulties that you may encounter in purchasing one. Whether you're looking for a new home or an investment property, this step-by-step guide will show you how to find, buy, and finance foreclosed property. Auctions - probably the most common way to buy a foreclosure home. Go to your desired areas county auction and place bids on homes. This will be. Whether you're looking for a new home or an investment property, this step-by-step guide will show you how to find, buy, and finance foreclosed property. This website contains all of the available foreclosures in the Twin Cities, MN. So please enjoy your MN foreclosure search! This article is designed to help you purchase your first foreclosed home while not loading you with tons of jargon and industry based terminology. First off most if not all lenders will not approve a purchase on a foreclosed home unless it is an eviction. Secondly no lender will lend you. The bank does not care if the home owners get money or onflashigri.online they want the loan paid off. Reply. Learn more about the benefits of purchasing a foreclosed or distressed home. Foreclosed properties have some common problems. In addition, there are some standard difficulties that you may encounter in purchasing one. Whether you're looking for a new home or an investment property, this step-by-step guide will show you how to find, buy, and finance foreclosed property. Auctions - probably the most common way to buy a foreclosure home. Go to your desired areas county auction and place bids on homes. This will be. Whether you're looking for a new home or an investment property, this step-by-step guide will show you how to find, buy, and finance foreclosed property. This website contains all of the available foreclosures in the Twin Cities, MN. So please enjoy your MN foreclosure search! This article is designed to help you purchase your first foreclosed home while not loading you with tons of jargon and industry based terminology. First off most if not all lenders will not approve a purchase on a foreclosed home unless it is an eviction. Secondly no lender will lend you. The bank does not care if the home owners get money or onflashigri.online they want the loan paid off. Reply. Learn more about the benefits of purchasing a foreclosed or distressed home.

Apply for a Mortgage Buying a foreclosed home isn't right for everyone. Your decision should depend on your risk tolerance, flexibility, and budget. Whether. Buying a foreclosure is a team effort. You, your expert foreclosure agent, experienced home inspector and contractors will all work together to make your dream. Texas has its own set of rules for this foreclosure hoedown, with timelines quicker than a two-step. Typically, from the notice of default, it's about 21 days. How to Buy Foreclosed Homes · Find a Foreclosed Home · Run the Numbers · Make Competitive Offer · Renovate the Property · Decide: Renting or Flipping. Buying a home in foreclosure can be a more affordable option for homebuyers who don't mind making renovations and repairs, but it is important to understand. Buying foreclosed properties at a foreclosure auction, or sheriff sale as they are commonly known, is a hit or miss prospect because more often than not the. As the FHA lending program requires that homes be habitable before purchase, sellers are usually obligated to make necessary updates prior to selling. However. To find foreclosed homes in Michigan, start by combing through online databases, local real estate listings, and foreclosure auction websites. The foreclosure process take a long time, and the buyer is likely going to be waiting for as long as a year and a half in some cases. Pre-foreclosure Property – Difficulty: Medium This is a home that is about to go into foreclosure but prior to the lender or trustee taking possession of the. Buying a foreclosed home can lead to unexpected expenses like back taxes, liens, and legal fees for eviction. Potential debts associated with the property could. I am having a hard time figuring out where and how to buy houses at anything less than full market value. How To Acquire Property In Public Foreclosure Auctions · Contact The Lender's Representative: To start, you'll want to contact the lender's representative. Buying a foreclosure is a team effort. You, your expert foreclosure agent, experienced home inspector and contractors will all work together to make your dream. The amount of risk and potential reward of buying a foreclosed home can vary depending on which part of the foreclosure process the home is in. All New Jersey foreclosed home auctions must be advertised for at least 4 weeks in a local newspaper. This can be done online at onflashigri.online In Florida, the method of foreclosure is through the judicial process, meaning the lender must file a lawsuit in state court. Let's walk you through how to buy a foreclosed home. We'll explain each step of the process, as well as any differences based on the foreclosure stage. A foreclosed home is one in which the pre-foreclosure options have elapsed and the lender (often a bank) takes possession of the home. Typically foreclosure homes in Michigan sell for % under the current market value. This means that you will receive a large discount to purchase a bank.

2 3 4 5 6